I invested in some Malaysians’ REIT through Bursa. One of the questions that I have is, after I passed away, how will my beneficiary inherit it. Then I came across the article shared on the Bursa Malaysia website on managing the Securities of a Deceased Investor.

According to Bursa, only the Personal Representative (PR) can manage the securities of a deceased investor. And the PR can be either:

- Executor (with Grant of Probate) or Administrator (Letter of Administration)

- A Beneficiary designated in the Distribution Order or Direction Order issued by Amanah Raya Berhad.

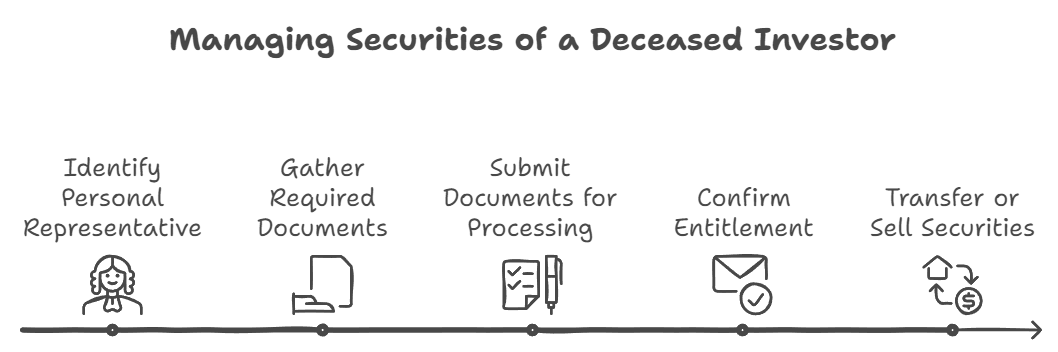

To manage the CDS account of a deceased investor, the steps generally involve:

- Gather all required documents, such as a grant of probate or letters of administration, death certificate, NRIC of Executor/Administrator/Beneficiary.

- Submit the documents for processing an validation

- After confirmation of entitlement, transferring or selling the securities as per the legal heir’s wishes or the will.

For more detailed steps, you can refer to Bursa Malaysia’s official guidelines here and FAQ.

This article is part of estate pre-planning, you can read the bigger picture or overview to get some ideas.